Garissa youth urged to join pension schemes for future financial security

RBA CEO called upon government agencies and non-state actors to intensify awareness campaigns and encourage individuals to save a portion of their earnings for retirement.

Youth in the informal sector received a compelling call on Wednesday to join pension schemes for a secure future.

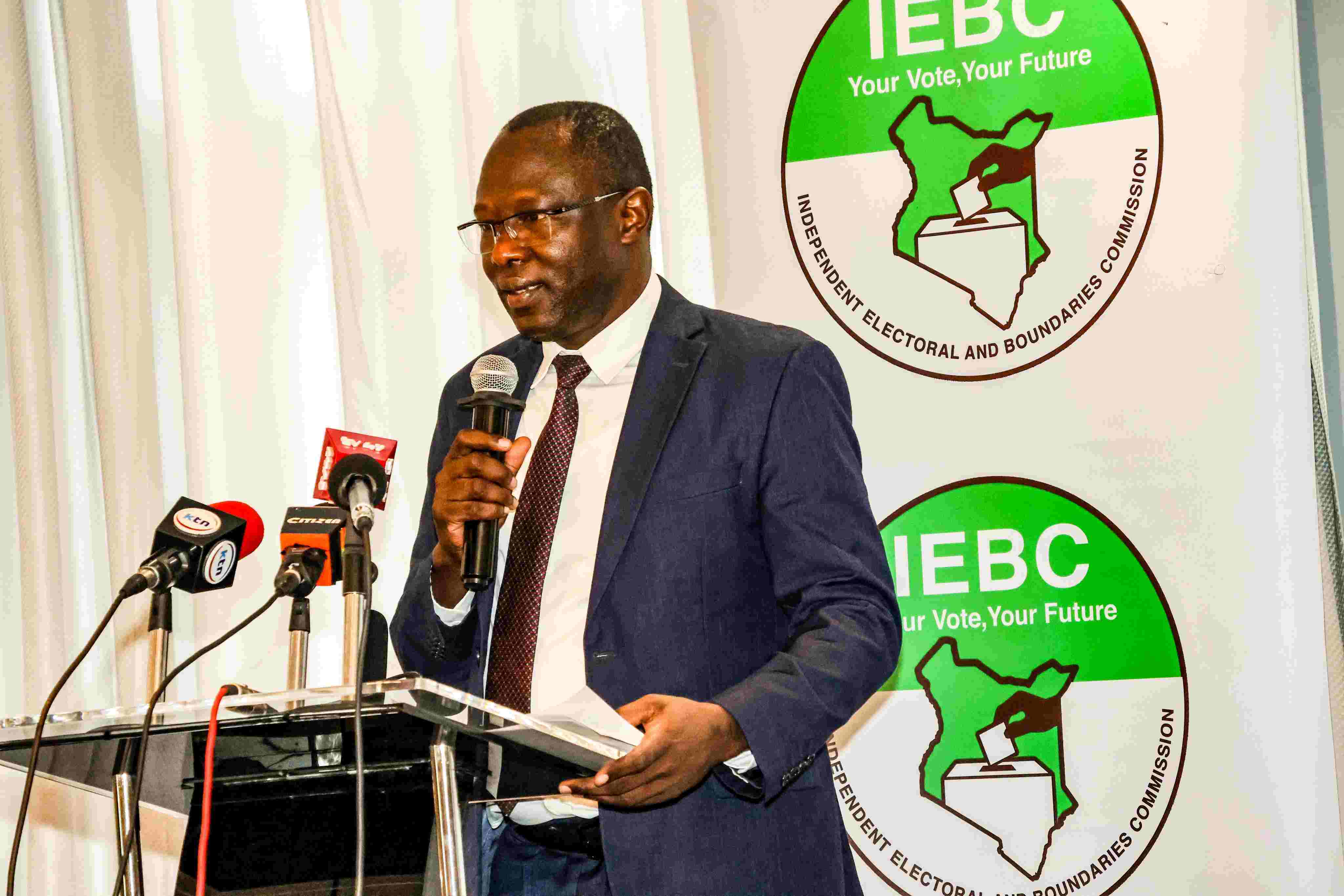

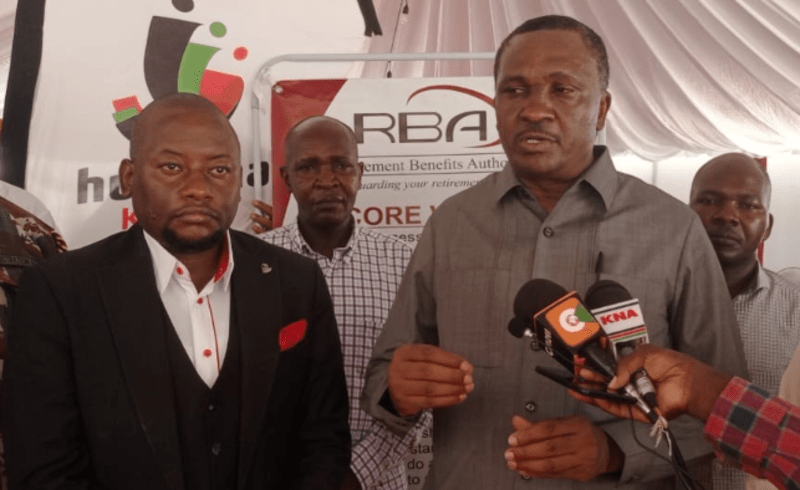

Addressing attendees at the Garissa Huduma Centre, Charles Machira, CEO of the Retirement Benefits Authority (RBA), emphasised the importance of enlightening the youth, who comprise the largest segment of the country's labour force, about planning for retirement.

More To Read

- Distance learning transforms lives while presenting unique challenges

- Youth still hardest hit by new HIV infections as Kwale marks World AIDS Day

- Garissa County launches digital livestock vaccination drive to boost pastoralist resilience

- Retirees demand action over Sh4 billion Nairobi Water pension arrears

- Garissa resident sues National Assembly over police service commission appointments

- ICEA survey finds most Kenyan retirees struggle to survive on pensions

"Nearly 85 per cent of our labour force operates in the informal sector and efforts must be geared towards ensuring they join the pension schemes," he said.

Machira highlighted a concerning statistic: only 26 per cent of individuals in the labour market are actively saving for retirement. This means that out of every 10 Kenyans in employment, 7 are at risk of facing poverty in their old age. He urged workers to proactively enrol in pension schemes to secure their future financial stability.

The CEO called upon both government agencies and non-state actors to intensify awareness campaigns and encourage individuals to save a portion of their earnings for retirement.

Additionally, he issued a stern warning to employers who withhold pension deductions from their employees but fail to remit them, stating that such actions will face legal consequences.

"Reports of non-remittance of deducted pension contributions are alarming. We will take decisive action to safeguard the savings of Kenyans," he cautioned.

Machira also emphasised the importance of timely pension disbursements, stating that retirees must receive their benefits within 30 days of retirement or voluntary exit from service.

Huduma Kenya acting CEO, Mugambi Njeru, reassured the public that all Huduma centres are committed to providing efficient retirement benefits services to employees.

Sharing his own experience, Hassan Noor, a retiree from the Youth Enterprise Fund, encouraged workers to prepare their pension documents early to ensure timely receipt of their benefits.

Top Stories Today